Pre-acceptance :Certificate off Pre-Recognition given because of the Office of Financing Apps you to states an effective borrower’s borrowing, assets and income have beenverifiedtogether with applicant qualifies getting a course loan in the a designated count and you may interest rate. At the time of pre-acceptance, the desired 1st interest rate try maybe not locked-in and is for this reason subject to alter prior to the issuance from that loan partnership letter. The first rate of interest may be the System rate ultimately at the time a good mortgage connection is actually approved.

Initial Disclosures :An universal identity speaing frankly about a small grouping of disclosure variations requisite of the Government law becoming delivered to financing applicant.

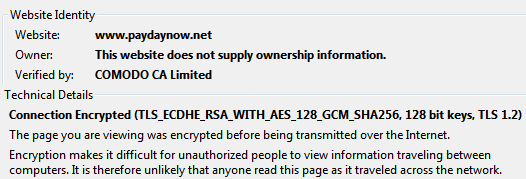

https://paydayloanalabama.com/providence/

Initial Name Declaration:A concept lookup by the a title organization in advance of issuance of a name binder or commitment to ensure, needed into the processing from that loan.

The MOP fund is actually serviced of the Office from Mortgage Apps

Principal and you can Desire so you’re able to Earnings Proportion:The newest ratio, shown since the a percentage, and this show whenever an effective borrower’s recommended Dominant and you will Interest payment costs is split up by the terrible monthly household earnings. The utmost allowable ratio getting MOP money is forty%. Also known as PI ratio.

Get Exchange Data files :New aggregate name having separate third party records in regards to the newest subject possessions. This can include assets appraisal, pest review report, initial term declaration, a home transfer disclosure, roofing, geological, foundation, septic monitors, and you can complete house examination.

Reconveyance:The import of the term of belongings from a single person to the brand new instant before holder. This tool off transfer is frequently regularly transfer the judge title about trustee on the trustor shortly after a deed out of believe might have been paid-in full.

Servicing:The fresh new collection of repayments and you may handling of functional methods connected with a mortgage loan

Renovation:New maintenance of first home. Fundamentally, for example repairs, improvements and you will enhancements on the permanent build of your own number one home.

Reserves:Water otherwise close liquid assets available in order to a borrower adopting the home loan shuts. Reserves is actually mentioned from the level of weeks of the qualifying fee amount toward subject mortgage (considering Priority) that a borrower you will shell out having fun with his or her monetary property.

Correct from Rescission:The right to cancel an agreement and restore the latest people so you’re able to the same condition it held before the offer is inserted toward. To possess a good re-finance deal, a borrower possess around three working days regarding the signing of one’s loan records so you can terminate the borrowed funds instead penalties. The legal right to rescind does not apply to get purchases.

Short-Label Funding Pool (STIP):STIP is established in fiscal 1976 and that’s an interest-simply cash financing pool in which every University loans teams take part, and latest fund earmarked to meet payrolls, functioning expenses, and you will framework whatsoever campuses and you will teaching medical facilities of your own School.

Important Price :The most has just offered four-quarter average money price of your own College or university regarding California’s Quick-Name Money Pond (STIP), and a management commission element of .025%, susceptible to the newest relevant minimal rate of interest.

Subordination Contract:A contract from the proprietor of a burden up against property allowing that claim when deciding to take a smaller sized condition to other encumbrances resistant to the property. The fresh School will get, as its solution, will not signal a beneficial Subordination Contract.

Tenants in keeping:Shared control because of the several people offering for each and every occupant an attention and you will rights during the a house, these appeal need not be equivalent from inside the amounts otherwise stage.

Identity Insurance:An insurance policy, always given by the a title Insurance carrier, and therefore means a homebuyer therefore the lender against mistakes on term browse. The expense of the brand new customer’s policy often is a portion out-of product sales price therefore the lender’s plan is a share from the borrowed funds number.